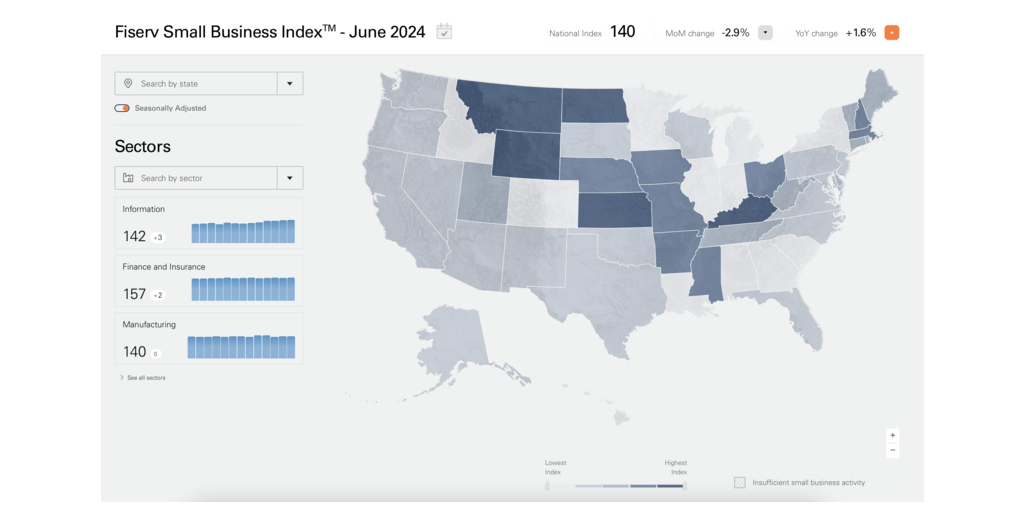

Fiserv Small Business Index declines to 140

Small business sales grew 1.6% year-over-year, and declined 2.9% month-over-month

MILWAUKEE–(BUSINESS WIRE)–Fiserv, Inc. (NYSE: FI), a leading global provider of payments and financial services technology, has published the Fiserv Small Business Index™ for June 2024. The Fiserv Small Business Index is an indicator of the performance of small businesses in the United States at national, state and industry levels.

“The Fiserv Small Business Index provides timely insight into small business performance well ahead of other economic indicators,” said Jennifer LaClair, Head of Merchant Solutions at Fiserv. “As consumers adjust their spending patterns, our ability to understand the impact on small businesses helps us work across our ecosystem to better support clients through a changing economic landscape.”

Nationally, the seasonally adjusted Fiserv Small Business Index for June declined to 140. On a year-over-year basis, both small business sales (+1.6%) and transactions (+4.4%) grew compared to June 2023, though the pace of growth is slowing. This is reflected in declines of small business sales (-2.9%) and transactions (-1.5%) month-over-month.

“As the quarter came to a close, consumers throttled back both spending and foot traffic across retail, restaurants and other service-based businesses,” said Prasanna Dhore, Chief Data Officer at Fiserv. “The slowdown was driven by a combination of lower average ticket sizes—the result of abating inflation and budget-conscious consumers—and a series of short-term seasonal demand shifts.”

Retail

Nationally, small business retail sales indexed at 142 in June, which reflects growth in year-over-year sales (+2.4%) and transactions (+7.0%) as consumers spent ahead of their 2023 pace. General Merchandise (+8.5%) outpaced all retail subsectors in yearly growth, followed by Gasoline Stations (+2.8%) and Health and Personal Care (+2.8%). Motor Vehicle and Parts Dealers (-4.1%) and Furniture/Electronics/Appliance Retailers (-1.2%) saw total sales decline year-over-year.

On a monthly basis, the impact was more significant as consumers sought deals and pulled-back on discretionary purchases, with month-over-month sales (-3.3%) and transactions (-0.8%) both trending downward. General Merchandise (+0.3%) was the only retail category to grow total sales from May to June. Gasoline Stations (-4.5%), Motor Vehicle and Parts Dealers (-5.9%), and Health and Personal Care (-7.2%) saw the sharpest declines month-over-month. Wholesale Trade, which tracks closely to Retail outcomes, also experienced a monthly slowdown (-4.0%).

Restaurant and Food Categories

Small business restaurant sales (+3.6%) and transactions (+2.3%) continue to grow year-over-year, though growth is also slowing. Average ticket sizes at small restaurants grew (+1.3%). Food and Beverage stores (which includes grocery) grew sales (+4.6%) and transactions (+8.1%) year-over-year.

Month-over-month, total restaurant sales (-1.2%) and transactions (-1.9%) declined. Average ticket sizes at restaurants were up slightly (+0.7%) from May, potentially signaling that rising food prices are dissuading spending. Unlike May, there was no evidence that consumers shifted typical restaurant spending to other food categories, such as grocery, which also softened (-0.3%) month-over-month.

Other Industry Movers

- Professional, Scientific, and Technical Services are seeing growth in sales (+9.0%) and transactions (+7.7%) year-over-year. Month-over-month sales declined (-2.9%) from May, although transactions were mostly flat (-0.3%).

- Specialty Trade Contractors grew sales (+1.6%) and transactions (+3.8%) year-over-year. Month-over-month sales (-2.1%) and transactions (-2.8%) tapered off as demand for general carpentry and light construction cooled.

- Additional strong year-over-year growth categories included Web Search Portals, Libraries and Related Services (+22.9%) and Amusement/Gambling/Recreation (+13.4%); the sharpest annual declines were in Real Estate (-14.2%) and Transportation Equipment Manufacturing (-14.0%).

- Web Search Portals, Libraries and Related Services (+2.4%), Amusement/Recreation/Gambling (+1.5%), and Insurance (+1.4%) were the fastest growing categories month-over-month. Spending slowed most in Truck Transportation (-8.9%) compared to May.

About the Fiserv Small Business Index™

The Fiserv Small Business Index is published during the first week of every month and differentiated by its direct aggregation of consumer spending activity within the U.S. small business ecosystem. Rather than relying on survey or sentiment data, the Fiserv Small Business Index is derived from point-of-sale transaction data, including card, cash, and check transactions in-store and online across approximately 2 million U.S. small businesses.

Benchmarked to 2019, the Fiserv Small Business Index provides a numeric value measuring consumer spending, with an accompanying transaction index measuring customer traffic. Through a simple interface, users can access data by region, state, and/or across business types categorized by the North American Industry Classification System (NAICS). Computing a monthly index for 16 sectors and 34 sub-sectors, the Fiserv Small Business Index provides a timely, reliable and consistent measure of small business performance even in industries where large businesses dominate.

To access the full Fiserv Small Business Index, visit fiserv.com/FiservSmallBusinessIndex.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500 company, aspires to move money and information in a way that moves the world. As a global leader in payments and financial technology, the company helps clients achieve best-in-class results through a commitment to innovation and excellence in areas including account processing and digital banking solutions; card issuer processing and network services; payments; e-commerce; merchant acquiring and processing; and the Clover® cloud-based point-of-sale and business management platform. Fiserv is a member of the S&P 500® Index and has been recognized as one of Fortune® World’s Most Admired Companies™ for 9 of the last 10 years. Visit fiserv.com and follow on social media for more information and the latest company news.

FI-G

Contacts

Media Relations:

Chase Wallace

Director, Communications

Fiserv, Inc.

+1 470-481-2555

chase.wallace@fiserv.com